Our Clients & tech partners

Expert Analysis Expert Advice.

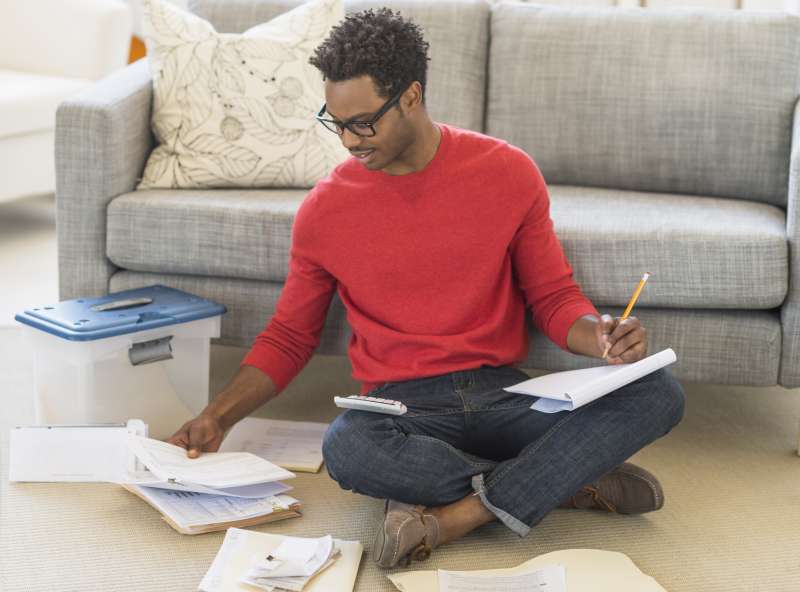

Every year, millions of taxpayers overpay their income

taxes—and we’re not talking about pocket change.

You could be missing out on hundreds or even

thousands of dollars.

WE PREPARE A WIDE RANGE OF TAXES

Services

Tax Consulting

Estate and Inheritance Tax Planning

Tax Compliance Services

Bookkeeping and Accounting

Tax Preparation

Business Tax Preparation

Tax Planning

Tax Resolution Services

Tax Consulting

Estate and Inheritance Tax Planning

Tax Compliance Services

Bookkeeping and Accounting

Tax Preparation

Business Tax Preparation

Tax Planning

Tax Resolution Services

File your taxes the smart way!

Your satisfaction, guaranteed

Maximum Refund

Maximizing your tax refund ensures that you retain more of your hard-earned money, leveraging available deductions and credits to optimize your financial outcome.

100% Accuracy

The importance of being 100% accurate in tax preparation lies in ensuring legal compliance, avoiding penalties, and providing clients with a trustworthy financial foundation for their peace of mind.

Analytics

Utilizing analytics in tax preparation enhances decision-making by extracting valuable insights from financial data, fostering precision, and optimizing strategies for a comprehensive and informed approach

Custom Software

The benefits of using custom software in tax return preparation include increased efficiency, tailored solutions to specific tax complexities, and enhanced accuracy, ensuring a streamlined and error-free process for both tax professionals and clients

Business Owner

Proficiently preparing business tax returns for all business structures requires a comprehensive understanding of diverse tax codes, tailored strategies for each entity type, and meticulous attention to detail to ensure compliance and optimize financial outcomes.

E-File

The e-file process streamlines tax preparation for our clients, providing a secure and efficient electronic filing platform that ensures faster processing, reduced errors, and quicker access to refunds.

Pricing

W-2 service starts

$500

Star ratings are from 2023

100% accurate calculations, guaranteed

Join our customer first family

Start in minutes by adding your tax docs - it’s as easy as snapping a photo

10-99 service starts

$700

Star ratings are from 2023

100% accurate calculations, guaranteed

Join our customer first family

Start in minutes by adding your tax docs - it’s as easy as snapping a photo

Business tax starts

$1000

Star ratings are from 2023

100% accurate calculations, guaranteed

Join our customer first family

Start in minutes by adding your tax docs - it’s as easy as snapping a photo

E-FILE GENIUS

SUBSCRIBE

& GET 10% OFF

We will share tax updates and promotions

Testimonials

What are our most loyal customers saying?

I have been doing my taxes with this company for the past two years and what I like the most is I can file my taxes and not have to think about it after. And if I have a question I can always talk to someone or even send a text and get a response.

The first time I spoke Coleen I was surprised just how knowlegabe she was. The reason I keep going back is because of the competence. These guys have been doing taxes for years, its not a seasonal job like a lot of other companies.

My taxes can be a bit complicated and I have worked with a lot of tax professionals in the past but these guys know there stuff. I learned in my first experience that I was overpaying almost every year and none of my tax guys in the past caught on that. If you like to work with people that know their stuff, this is the company to go with.

Super professional, knowlegable team. I have learned so much about taxes over the time I have worked with these guys. The biggest game changer for me was tax planning and I owe it to this company for getting me to where I need to be.

Previous

Next

accuracy

0

%

YOY

0

%

Years Of Team Exp

0

%

Star Service

0

YOY

0

%

Years Of Team Exp

0

%

Star Service

0

LETS CONNECT

CALL US

346-224-4188

EMAIL DIRECT

efilegenius@gmail.com.

LETS CONNECT

Fort Lauderdale, Fl

Houston, Tx